The Promise of Buy Now Pay Later for B2B eCommerce

Apr 30, 2021 / By ThinkInk

If ever there was a purchasing-spending model that best illustrates the adage "everything old is new again," it's the concept of buy now, pay later, or BNPL.

It's also a quintessentially American innovation, popularized about a century ago when a consumer goods revolution swept the nation. For the first time in history, laborsaving devices ranging from vacuum cleaners and irons to recreational items like phonographs, radios, and the family car suddenly became available for purchase by the newly minted middle class – sort of. The catch? Affording all this assembly-line-made awesomeness.

Enter 'buy now, pay later,' where shoppers could own a piece of the American Dream through store-specific lines of credit or zero or low-interest installment plans with an "easy" down payment. The result was essentially a triple win, and it's been the backbone of the global economy ever since. Consumers get the modern conveniences they crave; businesses increased their sales, profits, and liquidity. In time, universal credit card companies beginning with Diners' Club in 1950 would make oodles of cash on the interest paid on the debt.

The ABCs of B2B BNPL

Today, all of this pent-up margin buying institutional knowledge is finding a new home in the business-to-business market, especially the small and medium-sized enterprise subset with revenue from $50 million $1 billion. In large part, it's a payment and transaction revolution accelerated by the global pandemic. In the last 13 months, it's wrecked traditional B2B payment systems and upended the notion of "business as usual." So swift have the changes come that it's predicted the global B2B payment transaction market will be worth $63 billion by 2026 with a compounded annual growth rate above 6%, while BNPL apps have enjoyed a 162% increase in customer acquisition.

So what do I mean by "traditional B2B payment systems?" I mean, it's pretty hard to write a check to a supplier if your accounts payable person is at home on their couch. Likewise, it's hard to pay bills when the accounts receivable person is doing the same thing from afar. And both employees need to travel to the office to access their computer files, the physical checks (incoming and outgoing) – not to mention tracking down the boss for his or her John or "Jane" Hancock to move the process along.

Just as with B2C transactions, B2B BNPL, which dovetails as a component of the B2B payment market, is looking to achieve various goals. The most critical include:

- Increased liquidity (defined as: "the efficiency or ease with which an asset or security can be converted into ready cash without affecting its market price")

- Reduced transaction completion time (legacy payment methods and processes take about 30 days to complete, and 47% of SMEs report delinquent payment or services)

- Increased payment method flexibility, the elimination of high payment processing costs, and reduced risk of fraud.

The most significant difference between BNPL for B2C vs. B2B is one of scale. Yes, all consumers want fast, efficient, cost-effective, information-secure experiences. But for businesses dealing in large transaction volumes, a snag, even a small one, at any point in the process, can imperil profits – and productivity – leading to loss.

Meeting this rising demand has been a host of companies – Sweden-based Klarna, Australia-based Afterpay, US-based Affirm and Uplift, and earlier this year, with a decidedly B2B focus, Norway-based Tillit (which means "trust" in Norwegian), among others. All of them offer cashless payments in the forms of:

- ACH or other bank-to-bank transfers

- Mobile payments

- Online web portals

- Digital wallets

- Contactless payments

The BNPL component allows a B2B buyer to purchase their goods/services effectively on margin, while at the same time, a BNPL provider pays the seller in full, assuming their customer's default risk. That's where the liquidity advantage comes into play most clearly. Businesses accepting a BNPL transaction have nothing to lose. They can use their available funds to buy the goods/services they need to remain in business or spend that extra cash on hand on a host of in-store and online upgrades – both consumer-facing and internal. (The wish list is practically limitless)

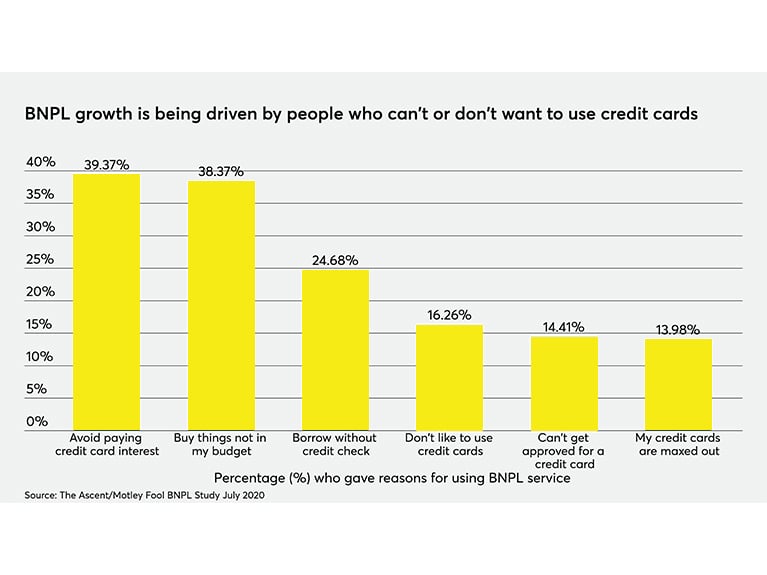

To be sure, there are plenty of parallels to other deferred payment methods, namely term loans, and credit cards. But term loans are intended for one-time large needs, often with a lengthy application process, causing some applicants to essentially give up. Meanwhile, traditional credit cards feature the same pain points all consumers know well: high-interest rates and low card approval percentages.

Putting our 'trust' in Tillet – and other BNPL providers

As noted above, Norway-based Tillet is one of the newest players on the BNPL digital block. According to its website, the company promotes its ability to speed up payment times (also known as invoice discounting or factoring) while offering billing options that can benefit cash flow and customers, plugging the drain in which one-third of B2B buyers abandon a service provider's checkout page due to a lack of suitable payment options. Additionally, the platform allows easy, no-hassle payment plans for a company's business customers while the business providing the goods or services receives immediate invoice settlement.

While Tillit features an easy invoice financing system, their platform also permits contract negotiation and has built-in back-end identification and credit analysis tools for accurate approvals.

As the global economy begins to rebound, with 2021 global GDP estimates around 5%, payment platforms like Tillet –and others – could prove an essential lifeline. BNPL platforms could serve as "middlemen" between Covid-strapped B2B buyers and sellers, increasing liquidity while streamlining the transaction process and eliminating (for the service provider) the risk of non-payment.

But remember, too, BNPL's two-way benefit. Buyers stand to gain as well. Just like B2C customers from a century ago whose heart went pitter-patter at the sight of their first Model T (or a dual-purposed stove-cooking electric iron), buying on margin keeps short-term cash on hand for these businesses as well. That lets them use their cash reserves more intelligently and in more diversified ways. With more cash on hand, B2B buyers have an opportunity to grow their revenue streams through marketing and advertising spend and the acquisition of new business. Doing so makes earlier committed goods and service payments easier to complete. That's how you do BNPL right.

As a strategic B2B marketing firm with domestic and international clients in the aviation, travel, loyalty, retail, and fintech industries, ThinkInk is no stranger to the challenges that these relationships and transactions (sometimes) represent. While we strive to streamline our processes to meet our clients where they are and be flexible to their budgets and cash on hand, platforms like Tillet bear important watching in the months and years ahead – both as a third-party transaction enabler – and as a client.

Lessons from the 'Roaring '20s for the Roaring '20s

Because ultimately, what B2B marketers aim to achieve is no different from our late 19th and early 20th century B2C forebears.

One hundred years ago, retailers and marketers learned a simple truth: to up their profits through increased sales, it was better to sell the emotional value of the instant gratification of an immediate buy rather than the purchased item alone, regardless of cost. This "special sauce," blurring the line between demand and desire and want and need, became the backbone of not only the American economy but the global one too.

B2B marketers are looking to sell their special sauce too. Whether it's a new app, a tangible product bought in bulk, cloud-based software as a solution, or earned or paid media, everything old really is new again.

Today's buy-now-pay-later platforms take the simplicity and brilliance of a 1920s revenue and liquidity-generating marketing approach and adapt it to a 2020s tech-savvy digital B2B marketer.

For B2B eCommerce, the "promise" of BNPL is fast becoming "proof."

Sign up for our insights on the convergence of business and PR